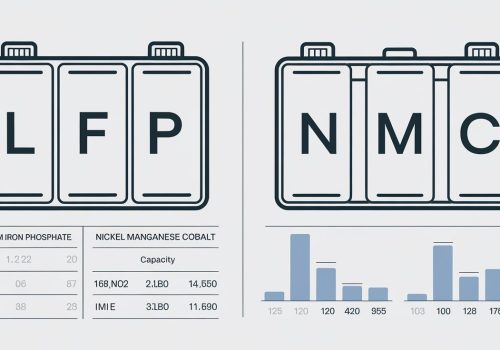

The Rise of Lithium Iron Phosphate (LFP) Battery Manufacturing in the United States: A Market Analysis

The demand for lithium-ion batteries in the United States is witnessing an unprecedented surge, driven by the rapid adoption of electric vehicles (EVs) and the need for energy storage solutions. Despite the growing market, the domestic manufacturing capacity for LFP batteries has been lagging, with a significant portion of the supply chain and production expertise concentrated in China. This article delves into the current state of LFP battery manufacturing in the U.S., market demands, and how the strategic positioning of Chinese manufacturers like Spiderway is filling the gap.

Introduction

Lithium iron phosphate batteries, known for their safety, longevity, and thermal stability, are becoming increasingly popular in various applications, from electric mobility to grid storage. The U.S. market, with its stringent requirements for domestic manufacturing, presents a unique opportunity for LFP battery producers to establish a foothold. However, the domestic production has been facing challenges such as supply chain dependencies and technological gaps.

Market Demand Analysis

The U.S. demand for LFP batteries is primarily driven by:

The EV market’s rapid expansion with regulatory pushes for cleaner transportation.

The need for reliable energy storage solutions to complement renewable energy sources.

The desire for energy independence and reduced reliance on foreign battery suppliers.

Current State of LFP Battery Manufacturing in the U.S.

The current landscape of LFP battery manufacturing in the U.S. is characterized by:

A limited number of established manufacturers.

Growing investments in research and development for LFP battery technologies.

Increasing collaborations with international partners to bring advanced production techniques to the U.S.

Spiderway’s Strategic Advantages

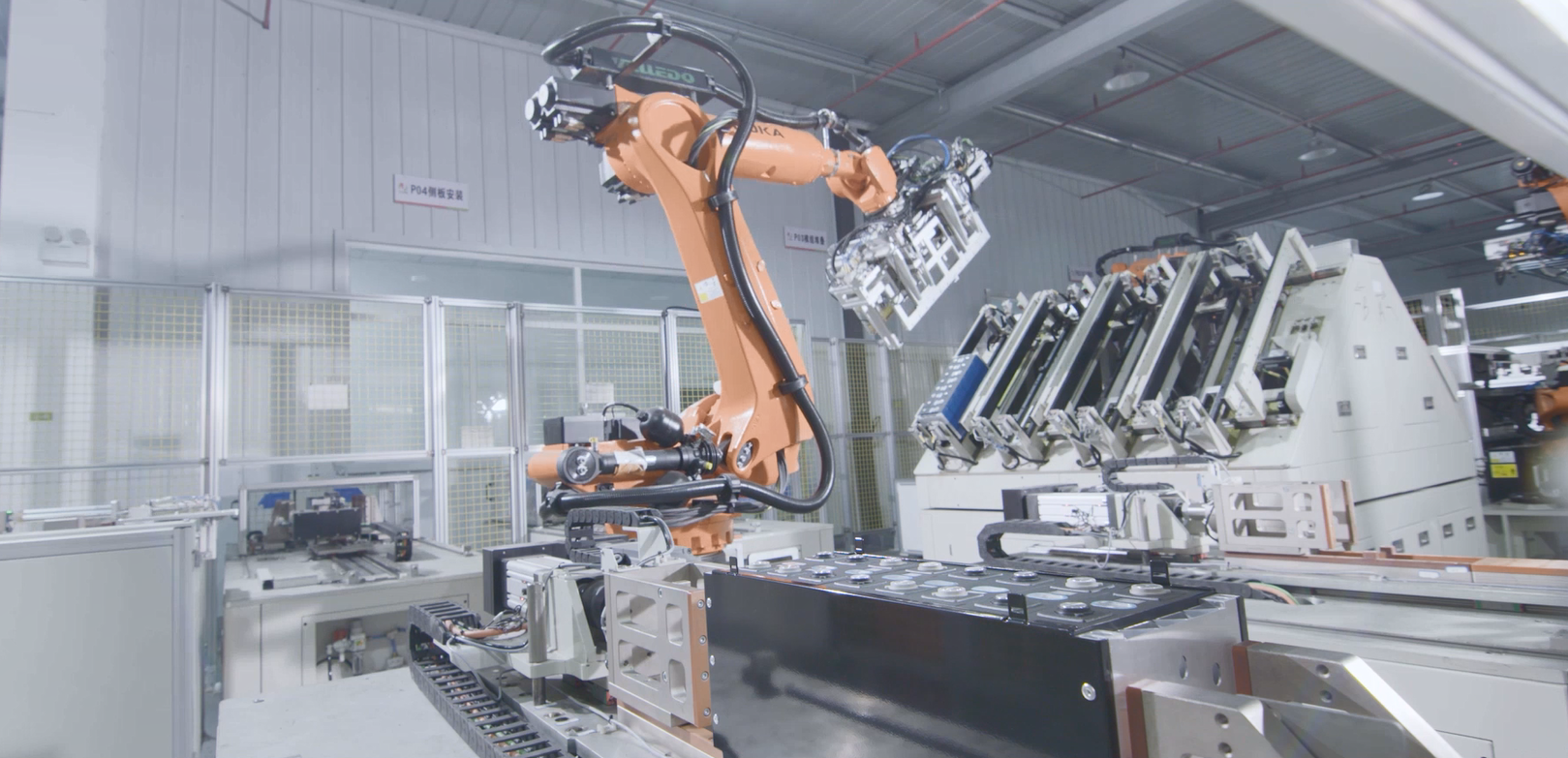

Spiderway, a leading LFP battery manufacturer, is leveraging China’s comprehensive lithium battery industry chain and economies of scale to offer competitively priced products. The company’s strategy includes:

Utilizing advanced manufacturing processes to ensure high-quality LFP batteries.

Offering customized solutions to meet the specific needs of U.S. clients.

Expanding its global footprint by establishing partnerships and joint ventures in the U.S. market.

Bridging the Capacity Gap

The LFP battery market in the U.S. is experiencing a capacity gap that is being addressed by:

The entry of international manufacturers like Spiderway.

Increased domestic investment in battery technology and manufacturing infrastructure.

Policy initiatives that encourage domestic production and create a favorable environment for LFP battery manufacturers.

Challenges and Opportunities

Despite the growing demand, the LFP battery manufacturing industry in the U.S. faces challenges such as:

Supply chain vulnerabilities, particularly for raw materials like lithium.

The need for skilled labor and investment in advanced manufacturing facilities.

Keeping pace with the rapid technological advancements in battery technologies.

However, opportunities abound for companies that can navigate these challenges, including:

Access to a large and growing market.

Potential for technological leadership in the LFP battery space.

The chance to contribute to the U.S.’s energy security and sustainability goals.

Conclusion

The U.S. LFP battery manufacturing sector is at a pivotal point, with significant potential for growth and development. As the market demand continues to rise, the strategic entry of international manufacturers like Spiderway, with their advanced technologies and competitive pricing, is set to play a crucial role in shaping the future of LFP battery production in the United States. By addressing the current capacity gap and leveraging the strengths of the global lithium battery industry, these manufacturers are well-positioned to support the U.S.’s transition towards a sustainable and energy-independent future.

48V 304AH LiFePO4 lithium battery for KOMATSU Forklift FB20-12 Type

48V 304AH LiFePO4 lithium battery for KOMATSU Forklift FB20-12 Type- Product on sale

48V 404Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00.

48V 404Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00. - Product on sale

48V 606Ah LiFePO4 lithium battery for HELI forkliftOriginal price was: $7,999.00.$7,978.00Current price is: $7,978.00.

48V 606Ah LiFePO4 lithium battery for HELI forkliftOriginal price was: $7,999.00.$7,978.00Current price is: $7,978.00. - Product on sale

80V 404Ah LiFePO4 lithium battery for HELI K2 3.5T forkliftOriginal price was: $8,399.00.$8,310.00Current price is: $8,310.00.

80V 404Ah LiFePO4 lithium battery for HELI K2 3.5T forkliftOriginal price was: $8,399.00.$8,310.00Current price is: $8,310.00. - Product on sale

48V 404Ah LiFePO4 lithium battery for LIUGONG 2.5TforkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00.

48V 404Ah LiFePO4 lithium battery for LIUGONG 2.5TforkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00. - Product on sale

80V 544Ah LiFePO4 lithium battery for TOYOTA forkliftOriginal price was: $11,199.00.$11,190.00Current price is: $11,190.00.

80V 544Ah LiFePO4 lithium battery for TOYOTA forkliftOriginal price was: $11,199.00.$11,190.00Current price is: $11,190.00. - Product on sale

48V 272Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $3,599.00.$3,581.00Current price is: $3,581.00.

48V 272Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $3,599.00.$3,581.00Current price is: $3,581.00. - Product on sale

24V 202Ah LiFePO4 lithium battery for LINDE T20 forkliftOriginal price was: $1,399.00.$1,329.00Current price is: $1,329.00.

24V 202Ah LiFePO4 lithium battery for LINDE T20 forkliftOriginal price was: $1,399.00.$1,329.00Current price is: $1,329.00. - Product on sale

48V 544Ah LiFePO4 lithium battery for HELI CPD20-F1 forkliftOriginal price was: $7,199.00.$7,162.00Current price is: $7,162.00.

48V 544Ah LiFePO4 lithium battery for HELI CPD20-F1 forkliftOriginal price was: $7,199.00.$7,162.00Current price is: $7,162.00.

Author Profile

- https://tawk.to/chat/6228c78d1ffac05b1d7dc569/1ftnkn0nk

- SpiderWay LiFePO4 battery sales engineer with ten years of experience in industrial vehicle batteries, ready to answer any questions you may have about industrial LiFePO4 battery products.

Latest entries

Battery Charger KnowledgeNovember 15, 2024LFP (LiFePO4) Battery Charger Supplier from China: The Ultimate Solution for EV and Renewable Energy Applications

Industry NewsNovember 15, 2024China ESS Energy Storage Battery Manufacturers: Industry Development Data and Future Market Trends

Cleaning MachinesNovember 15, 2024Global Leading Cleaning Machines Brands & LFP Lithium Battery Solutions: Powering the Future of Cleaning Technology

Industry NewsNovember 15, 2024Embracing the Energy Transition for a Sustainable Future