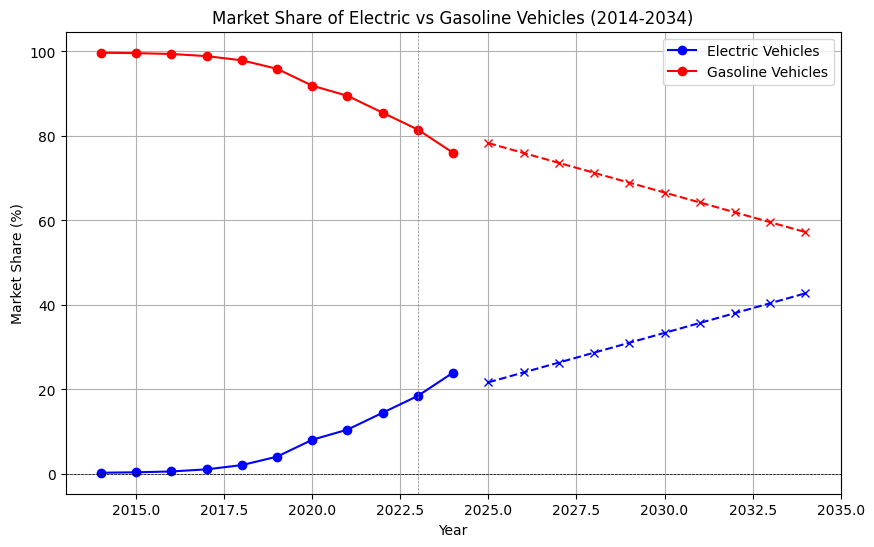

Market Share Trends of Electric vs. Gasoline Vehicles (2014-2034)

Over the past decade, the automotive industry has undergone a significant transformation, particularly with the rise of electric vehicles (EVs) and the gradual decline of gasoline vehicles. This article analyzes the market share changes of electric and gasoline vehicles from 2014 to 2024, predicts future trends for the next decade, and highlights the role of SPIDERWAY in the LFP battery OEM manufacturing sector.

Historical Market Share Data

The following data illustrates the market share of electric and gasoline vehicles over the past ten years:

- 2014: Electric Vehicles (0.3%), Gasoline Vehicles (99.7%)

- 2015: Electric Vehicles (0.4%), Gasoline Vehicles (99.6%)

- 2016: Electric Vehicles (0.6%), Gasoline Vehicles (99.4%)

- 2017: Electric Vehicles (1.1%), Gasoline Vehicles (98.9%)

- 2018: Electric Vehicles (2.1%), Gasoline Vehicles (97.9%)

- 2019: Electric Vehicles (4.1%), Gasoline Vehicles (95.9%)

- 2020: Electric Vehicles (8.1%), Gasoline Vehicles (91.9%)

- 2021: Electric Vehicles (10.5%), Gasoline Vehicles (89.5%)

- 2022: Electric Vehicles (14.5%), Gasoline Vehicles (85.5%)

- 2023: Electric Vehicles (18.5%), Gasoline Vehicles (81.5%)

- 2024: Electric Vehicles (24.0%), Gasoline Vehicles (76.0%)

Future Predictions (2025-2034)

Using a linear regression analysis based on the past decade’s data, we can forecast the market share for electric and gasoline vehicles over the next ten years:

- 2025: Electric Vehicles (21.7%), Gasoline Vehicles (78.3%)

- 2026: Electric Vehicles (24.0%), Gasoline Vehicles (76.0%)

- 2027: Electric Vehicles (26.4%), Gasoline Vehicles (73.6%)

- 2028: Electric Vehicles (28.7%), Gasoline Vehicles (71.3%)

- 2029: Electric Vehicles (31.1%), Gasoline Vehicles (68.9%)

- 2030: Electric Vehicles (33.4%), Gasoline Vehicles (66.6%)

- 2031: Electric Vehicles (35.7%), Gasoline Vehicles (64.3%)

- 2032: Electric Vehicles (38.1%), Gasoline Vehicles (61.9%)

- 2033: Electric Vehicles (40.4%), Gasoline Vehicles (59.6%)

- 2034: Electric Vehicles (42.8%), Gasoline Vehicles (57.2%)

Analysis of Trends

The data indicates a clear upward trend in the market share of electric vehicles, driven by advancements in technology, increased consumer awareness, and government incentives. As battery technology improves and charging infrastructure expands, the adoption of EVs is expected to accelerate further.

support this transition with high-quality LFP batteries, ensuring they remain at the forefront of the electric vehicle revolution.

Global Market Trends (2014-2024)

Over the past decade, the global market for electric vehicles (EVs) has experienced significant growth, while the market share for gasoline vehicles has steadily declined. Here are some key trends:

- 2014-2023: The global market share of electric vehicles increased from a mere 0.3% in 2014 to approximately 20% by 2023. This growth has been driven by technological advancements, government incentives, and increasing consumer awareness of environmental issues[2][5].

- 2024 Projections: By the end of 2024, electric vehicles are expected to account for 20% of total global car sales, with sales reaching around 17 million units[5].

China Market Trends (2014-2024)

China has been a major driver of the global EV market, with substantial growth in electric vehicle adoption:

- 2014-2023: China’s market share for electric vehicles surged from less than 1% in 2014 to about 45% of total car sales by 2024. This rapid increase is attributed to strong government support, competitive pricing, and a robust domestic manufacturing sector[3].

- 2024 Outlook: Electric vehicle sales in China are projected to reach around 10 million units in 2024, maintaining a dominant position in the global market[3].

Future Predictions (2025-2034)

Based on current trends and technological advancements, the following predictions can be made for the next decade:

- Global Market: By 2034, electric vehicles could potentially hold over 50% of the global market share. This shift will be supported by continued innovations in battery technology, expanding charging infrastructure, and stricter emissions regulations.

- China Market: In China, electric vehicles might capture up to 60% of the market share by 2034, as the country continues to lead in EV production and adoption.

SPIDERWAY: Pioneering LFP Battery OEM Services

SPIDERWAY Anhui Technical Co., Ltd. is at the forefront of providing OEM services for lithium iron phosphate (LFP) batteries, essential for powering electric vehicles. Key advantages of SPIDERWAY include:

- Extensive Experience: With years of expertise in the industry, SPIDERWAY delivers high-quality, reliable battery solutions.

- Customization: The company offers tailored battery solutions to meet diverse client needs, ensuring optimal performance and efficiency.

- Production Capacity: SPIDERWAY’s robust manufacturing capabilities enable it to meet the growing demand for LFP batteries, supporting the global shift towards electric mobility.

48V 304AH LiFePO4 lithium battery for KOMATSU Forklift FB20-12 Type

48V 304AH LiFePO4 lithium battery for KOMATSU Forklift FB20-12 Type- Product on sale

48V 404Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00.

48V 404Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00. - Product on sale

48V 606Ah LiFePO4 lithium battery for HELI forkliftOriginal price was: $7,999.00.$7,978.00Current price is: $7,978.00.

48V 606Ah LiFePO4 lithium battery for HELI forkliftOriginal price was: $7,999.00.$7,978.00Current price is: $7,978.00. - Product on sale

80V 404Ah LiFePO4 lithium battery for HELI K2 3.5T forkliftOriginal price was: $8,399.00.$8,310.00Current price is: $8,310.00.

80V 404Ah LiFePO4 lithium battery for HELI K2 3.5T forkliftOriginal price was: $8,399.00.$8,310.00Current price is: $8,310.00. - Product on sale

48V 404Ah LiFePO4 lithium battery for LIUGONG 2.5TforkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00.

48V 404Ah LiFePO4 lithium battery for LIUGONG 2.5TforkliftOriginal price was: $5,399.00.$5,318.00Current price is: $5,318.00. - Product on sale

80V 544Ah LiFePO4 lithium battery for TOYOTA forkliftOriginal price was: $11,199.00.$11,190.00Current price is: $11,190.00.

80V 544Ah LiFePO4 lithium battery for TOYOTA forkliftOriginal price was: $11,199.00.$11,190.00Current price is: $11,190.00. - Product on sale

48V 272Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $3,599.00.$3,581.00Current price is: $3,581.00.

48V 272Ah LiFePO4 lithium battery for LIUGONG forkliftOriginal price was: $3,599.00.$3,581.00Current price is: $3,581.00. - Product on sale

24V 202Ah LiFePO4 lithium battery for LINDE T20 forkliftOriginal price was: $1,399.00.$1,329.00Current price is: $1,329.00.

24V 202Ah LiFePO4 lithium battery for LINDE T20 forkliftOriginal price was: $1,399.00.$1,329.00Current price is: $1,329.00. - Product on sale

48V 544Ah LiFePO4 lithium battery for HELI CPD20-F1 forkliftOriginal price was: $7,199.00.$7,162.00Current price is: $7,162.00.

48V 544Ah LiFePO4 lithium battery for HELI CPD20-F1 forkliftOriginal price was: $7,199.00.$7,162.00Current price is: $7,162.00.

SPIDERWAY: Leading the Charge in LFP Battery OEM Manufacturing

As the electric vehicle market continues to grow, SPIDERWAY Anhui Technical Co., Ltd. stands out as a leading manufacturer of LFP (lithium iron phosphate) batteries. With extensive experience in OEM manufacturing, SPIDERWAY offers several advantages:

- Quality Assurance: SPIDERWAY ensures that all products meet international standards, providing reliable and efficient power solutions for electric vehicles.

- Customization: The company specializes in tailored battery solutions, adapting to the specific needs of various clients in the automotive industry.

- Scalability: With a robust production capacity, SPIDERWAY can meet the increasing demand for LFP batteries as the market for electric vehicles expands.

The shift towards electric vehicles is not just a trend; it is a fundamental change in the automotive landscape. Companies like SPIDERWAY are well-positioned to support this transition with high-quality LFP batteries, ensuring they remain at the forefront of the electric vehicle revolution.

Author Profile

- https://tawk.to/chat/6228c78d1ffac05b1d7dc569/1ftnkn0nk

- SpiderWay LiFePO4 battery sales engineer with ten years of experience in industrial vehicle batteries, ready to answer any questions you may have about industrial LiFePO4 battery products.

Latest entries

BetcoNovember 16, 2024Electric Floor Cleaners Cleaning Machines LFP Power Lithium Battery OEM Manufacturer Recommendations

Battery Charger KnowledgeNovember 16, 2024LFP (LiFePO4) Battery Charger Supplier from China: The Ultimate Solution for EV and Renewable Energy Applications

Industry NewsNovember 15, 2024China ESS Energy Storage Battery Manufacturers: Industry Development Data and Future Market Trends

Cleaning MachinesNovember 15, 2024Global Leading Cleaning Machines Brands & LFP Lithium Battery Solutions: Powering the Future of Cleaning Technology