Explore Germany’s power lithium battery industry, focusing on LiFePO4 battery development, market size, key players like Volkswagen, Siemens, and Liebherr, and a comparison with China’s production capabilities.

Introduction

Germany has emerged as a significant player in the global power lithium battery market, particularly in the development and production of LiFePO4 (Lithium Iron Phosphate) batteries. As the demand for sustainable energy solutions and electric mobility grows, Germany’s industrial lithium battery sector is experiencing rapid expansion. This article delves into the development of Germany’s power lithium battery industry, with a focus on LiFePO4 batteries, market size, prominent manufacturers, and the integration of lithium battery technology by major companies such as Volkswagen, Siemens, and Liebherr. Additionally, it compares Germany’s advancements with China’s production capabilities and highlights the advantages of SPIDERWAY‘s LiFePO4 power lithium batteries.

Development of Germany’s Power Lithium Battery Industry

Germany’s commitment to renewable energy and sustainable transportation has spurred significant growth in its power lithium battery industry. The country’s focus on research and development, coupled with substantial investments in battery technology, has positioned it as a leader in the European battery market. The German government’s support through policies and incentives has further accelerated the adoption of lithium battery technologies across various sectors.

LiFePO4 Battery Development

LiFePO4 batteries are gaining traction in Germany due to their safety, longevity, and environmental benefits. These batteries offer thermal stability and a longer lifespan compared to other lithium-ion batteries, making them ideal for industrial applications. German manufacturers are increasingly investing in LiFePO4 technology to meet the rising demand for efficient and reliable energy storage solutions.

Market Size and Growth

The German battery market has witnessed substantial growth in recent years. In 2023, the market expanded by 32%, reaching €23.2 billion. Notably, lithium-ion batteries accounted for the largest market share, with sales amounting to €18.9 billion, marking a significant 58% increase. This growth is driven by the rising demand for electric vehicles, renewable energy storage, and industrial applications.

Key Players and Integration of Lithium Battery Technology

Several prominent German companies are integrating lithium battery technology into their operations:

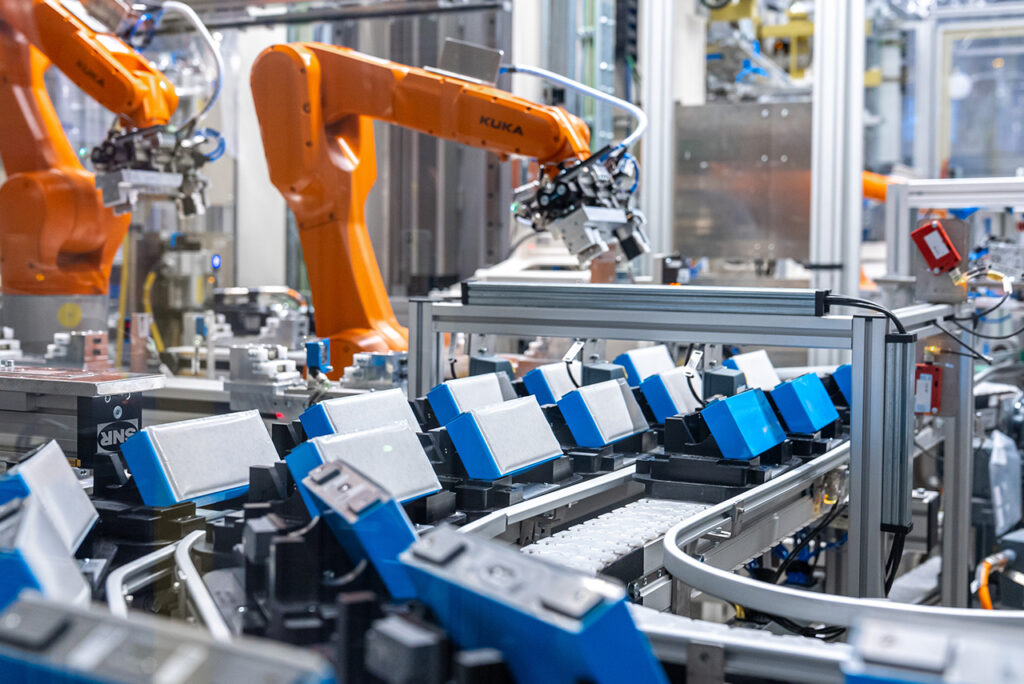

- Volkswagen: As part of its electrification strategy, Volkswagen is investing heavily in battery technology. The company is establishing battery production facilities in Germany to support its electric vehicle lineup, aiming to produce high-quality batteries domestically to reduce reliance on external suppliers.

- Siemens: Siemens is involved in the development of battery management systems and infrastructure for energy storage solutions. The company collaborates with battery manufacturers to enhance the efficiency and integration of lithium batteries in industrial applications.

- Liebherr: Known for its construction machinery, Liebherr is incorporating lithium battery technology into its equipment to promote sustainability and reduce emissions. The company focuses on developing battery-powered machinery that meets the demands of modern construction and industrial operations.

Comparison with China’s Lithium Battery Industry

China leads the global lithium battery market, with a well-established supply chain and large-scale production capabilities. In contrast, Germany emphasizes quality, safety, and technological innovation. While China’s battery industry benefits from cost advantages and high production volumes, Germany focuses on specialized applications and high-performance batteries, particularly in the industrial sector.

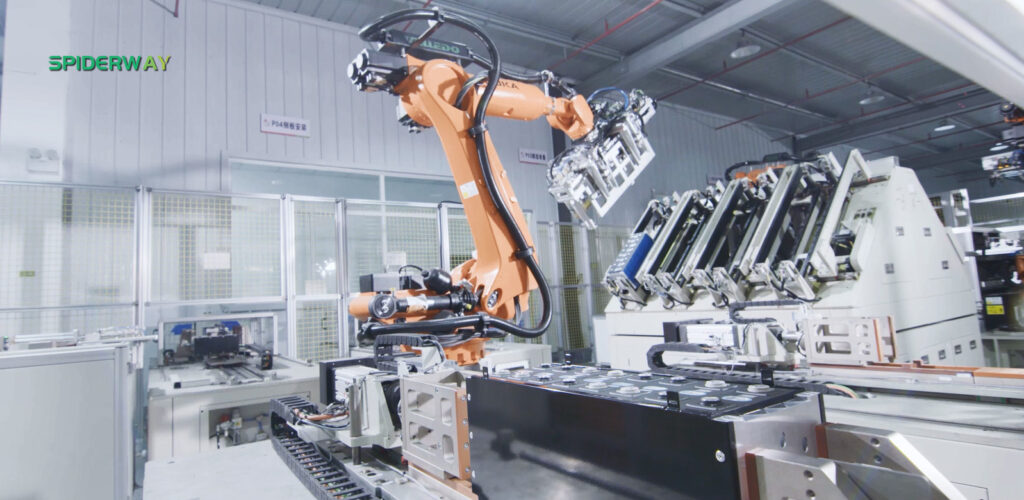

SPIDERWAY’s LiFePO4 Power Lithium Battery Advantages

SPIDERWAY offers LiFePO4 power lithium batteries that combine the benefits of advanced technology with high production capacity. These batteries provide:

- High Energy Density: Ensuring longer operational times for industrial applications.

- Enhanced Safety: Superior thermal stability reduces the risk of overheating.

- Long Lifespan: Durable design leads to cost savings over time.

- Environmental Friendliness: LiFePO4 batteries are more environmentally friendly compared to traditional battery chemistries.

With a robust production capacity, SPIDERWAY can meet large-scale demands, offering reliable and efficient energy solutions for various industrial needs.

Conclusion

Germany’s power lithium battery industry is rapidly evolving, with significant advancements in LiFePO4 battery technology. The market’s growth is supported by key players like Volkswagen, Siemens, and Liebherr, who are integrating lithium battery solutions into their operations. While China’s battery industry dominates in scale, Germany’s focus on quality and specialized applications positions it as a strong competitor in the global market. SPIDERWAY’s LiFePO4 power lithium batteries offer a compelling option, combining advanced technology with substantial production capacity to meet diverse industrial requirements.